2023 Forecast for Cold Chain | Disruptive with a semblance of order.

- Vinayak Thakar

Never have I ever, in my decade and a half long career in cold chain industry; seen such volatile business micros like I have in the past three years. In 2023, personally. I prefer to see trends-current rather than current-trends as the big picture. The coming year will invariably demand from everyone, to have adaptive abilities on the go sans the privilege of preparing for the change. Rather adapting to the cold chain variables in order of their occurrence or may be not. 2023 in my opinion will most likely be a semblance of disruptive balance and order.

Mettcover Global R&D & Manufacturing Unit.

As somebody who is responsible for management of a manufacturing unit of passive cold chain packaging, we are continually adapting to the milieu of front and back-end integration and resource management whilst ensuring that innovation remains our full time job.

Image – Mettcover Global Image Archive

In the past year, I finally got ample chances to travel for business. As an ambassador of Mettcover Global, we were well received to forge important relationships with our global partners. You should know that cold chain people talk about pharmaceuticals like the British talk about football. So naturally, the topic of mitigating risks in the cold logistic especially in the Pharmaceuticals Cold-Chain was a common discussion point with most associates I met.

Almost everyone was gung-ho about broader demand but utterly worried about the fear of the unknown. The new normal is constantly getting morphed and nobody knows what normal would look like in the next quarter. Even most liberals will agree that 2023 is a complete unchartered territory with geo political upheaval and mutant viruses lurking around every corner. Yet, based on my experiences, observations and exhaustive conversations with the industry players, I see that these trends may find prominence in 2023 with in the Supply Chain Industry in general and Cold-Chain in particular.

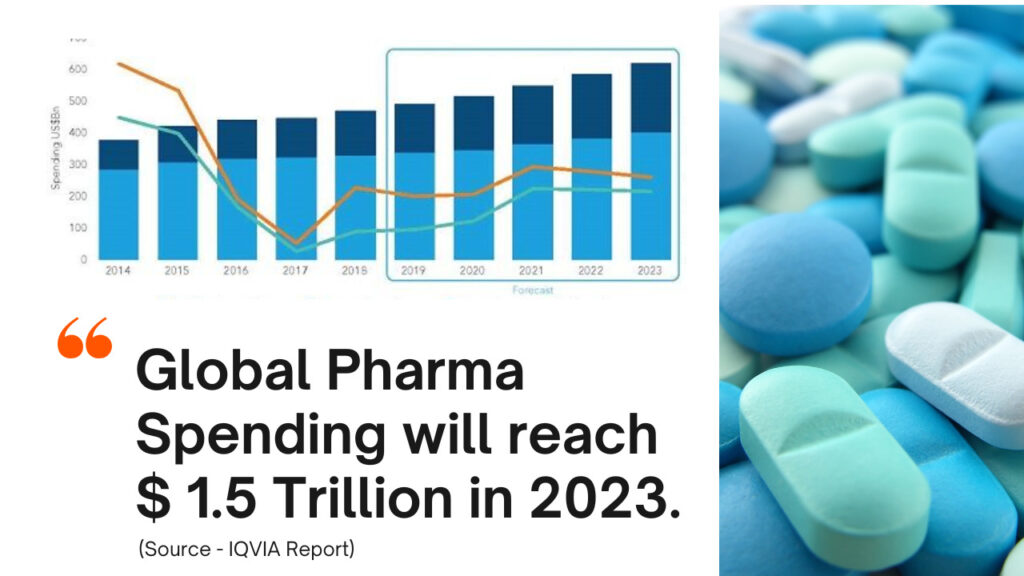

Pharmaceuticals Industry continues to be the biggest stakeholder in Cold-Chain.

Most Governments are in a vigilant mode about new COVID variants. A possibility of a new infection wave cannot be ruled out which brings the world’s focus on pharmaceuticals industry. Further, the general public interest in preventive health has brilliantly boosted Pharma Sector’s growth projection.

The continent of North America should be able to maintain its dominance

on the Pharma Cold Chain but may also see increased participation of perishables.

A bigger chunk of growth for thermal pallet covers should come from emerging economies especially India which is pacing to fill in the gap left by the Chinese companies. Most will agree to have witnessed the Indian government’s impetus on developing ancillary services such as ports, trade compliances etc. to the imperative of making India as the world’s pharmacy.

I will limit my insights into the Pharma Cold Chain that moves shipment of a specific temperature profile of 15 – 25 degree Celsius. Primarily because I conduct a lot of research in this area considering that our primary offering; Thermal Pallet Cover, is an excellent supplement to this’ whether medicines or health supplements.

As single offerings, and for shipments requiring to maintain lower temperatures,

the reusable prequalified shippers for Pharmaceuticals may gather popularity in 2023.

The leasing trend of prequalified and re-usable ULDs made

under the purview of stringent ISTDA 7 testing norms should also see growing demand.

Tech-Automation and Un-Broken Data Chain.

I figure that it is only logical that equipment and data automation will well continue in 2023, more so rapidly. While many companies including ours are integrating automation in work flows to minimize the errors, I concur that Predictive Analytics and Digitization of data will catch up with speed in the coming year. Data visualization is the primary key here and curating actionable data sets can give a sneak preview of the uncertain future. Variable such as Weather, Flight Schedules, and, Modular Team Positions have capacity to damage the cold chain effectiveness. The prevalent technologies if not nullified can definitely contain these risks.

MettTemp Data Loggers are ready to ship in 2023.

The application of data loggers may not only grow manifold but will be technology driven; influenced by smart contracts and Internet of things (IoT). Real time data built up will be used extensively to assess the error profiles. The technologies around it will get affordable and more accessible to limit risk in the pharma cold chain

Almost everyone I have interacted in the last year has been prudent enough to digitize their data, even if in a small way of a simplistic but connected CRM or through the leap of opting for ERP. Similarly, in 2023, the cold chain industry, for all the right reasons must lay significant emphasis on Asset Tracking via neo-modern technology.

2023 will be the year of Sustainability (in practice).

It is only obvious that the global narrative of sustainability is going to grow in intensity. In the last couple years, cold chain industry has definitively been vocal on the Green Push and the coming year should see steps taken in practice to achieve the higher ground of sustainability. As difficult as it is, 2023 (in a paradigm shift) will see stronger green shoots to the extent of sustainable manufacturing practices, choice of raw materials and overall gradual integration of elements that will take us further away from using fossil fuels and wrong waste management practices.

Most large fleet owners I met in Europe and America are more comfortable with hydrogen powered heavy vehicles over electric ones. This indicates heavy upcoming innovation in hydrogen fuel cell technology. In my opinion, we are living in utterly exciting times to be able to witness technology break-through like this.

May be the emerging economies will buck the global trend but in 2023, or maybe not. I see an overall subdued demand. The further stabilization of fuel prices and reduction supply disruptions indicate that pricing will also remain in a stable range. As far as the supply and demand correlation goes, it is safe to say that lower consumer demand will restrict the cost of moving cold chain cargo. Many may opt to use 3PL service providers, for cost, efficiency and primarily for gaining access to a valid Transport management System. 3PL as a sub sector may rise in terms of volume growth if not pricing.

Cold Chain and the Workforce Disruptions.

The bigger spoiler for the cold chain industry in 2023 can be very well the skilled work force or rather its scarcity. As inflation looms, people are switching jobs more than often and over all the attrition in most industries was very high throughout last year.

This may not change overnight. A happy workplace is easier said than done.

The mandate of retaining talent will force all organizations to upgrade working conditions, work policies and enable a holistic quality of life for their work force. This is definitely a much awaited correction to the way Cold Chain Industry has operated in the last decade. Nevertheless, overhauling work systems may hit the bottom-line for many us unless executed under the astute guidance of Change Management and Design Thinking Process. Of course, technology and humanity will both play a major role.

To conclude, they say that forecasts tell a little about the future but a lot about the forecaster. I have chosen to share my experiences and understanding with the Mettcover Cold-Chain Community for the privilege of your readership. As always, come 2023, everyone at Mettcover Global, vehemently remains committed to enablement of a sustainable , smarter cold chain solutions. We will be delighted to incorporate any suggestions from our friends.

Wishing you a very Happy New Year 2023.