Global Air Cargo Volumes Show First Sign of Growth in over 19 months. Who’s Moving How Much? Lets Find Out.

- Samantha Garcia

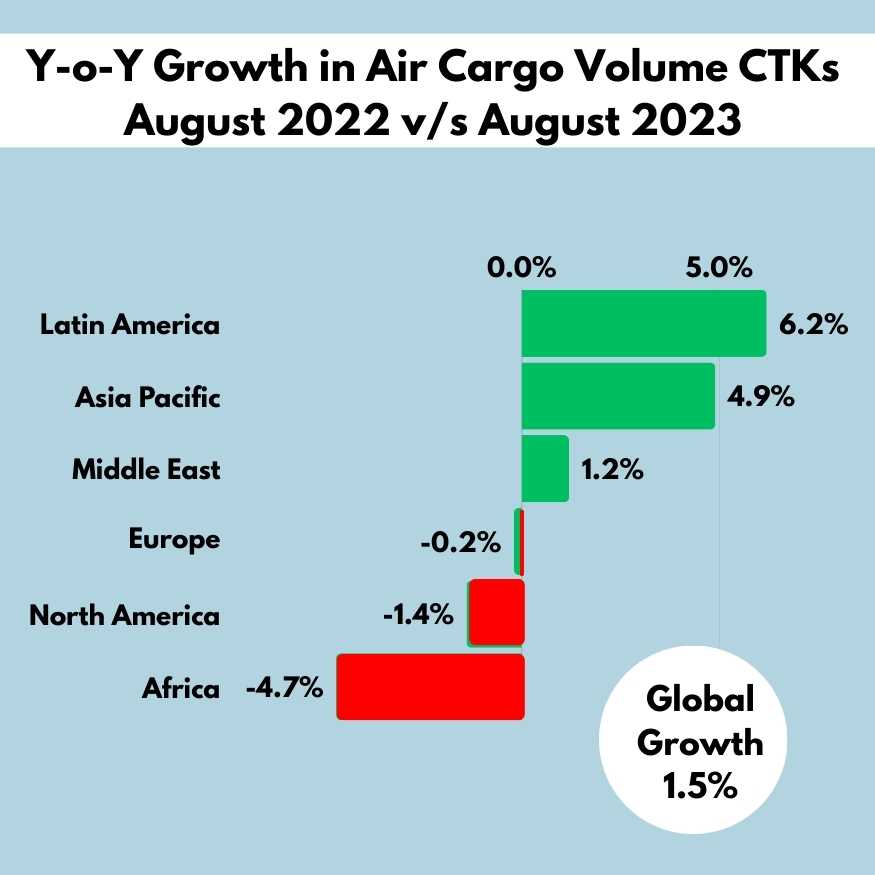

Air Cargo volumes in North America and Europe shrink while Latin America, followed by Asia Pacific leads the much awaited growth. A week back International Air Transport Association (IATA) releases the air cargo volume data of August 2023. The global air cargo industry witnessed a long-awaited positive growth of 1.5% in August 2023 compared to the same period last year. This marks the first year-on-year growth in air cargo demand in 19 months, signaling a notable shift in a sector grappling with various challenges.

The demand, measured in cargo ton-kilometers (CTKs), saw this surge, reflecting a slow but steady recovery in the global market. The capacity, measured in available cargo ton-kilometers (ACTKs), also showed a notable rise of 12.2% compared to August 2022. This was primarily due to increased belly capacity, indicating that airlines are scaling up operations to meet the heightened demand during the peak summer travel season in the Northern Hemisphere.

The Operating Environment:

Several factors in the operating environment played a crucial role in shaping this growth. The Purchasing Managers Index (PMI) for both manufacturing output and new export orders saw a slight improvement in August compared to the previous month. However, they remained below the critical threshold of 50, signifying a continued decline in global manufacturing production and exports, albeit at a slower pace.

Global cross-border trade contracted for the fourth consecutive month in July, reflecting a cooling demand environment and challenging macroeconomic conditions. Additionally, the inflation scenario varied across regions. While the US saw an increase in consumer prices for the second consecutive month, Europe, Japan, and China experienced fluctuations.

August 2023 (% Year-on-Year) Performance

| Region | World Share | CTK (%) | ACTK (%) | CLF (%-PT) | CLF (LEVEL) |

| Total Market | 100% | 1.5% | 12.2% | -4.4% | 42.0% |

| Africa | 2.0% | -4.7% | 3.8% | -3.5% | 38.8% |

| Asia Pacific | 32.4% | 4.9% | 28.5% | -9.9% | 44.3% |

| Europe | 21.8% | -0.2% | 3.6% | -1.8% | 48.4% |

| Latin America | 2.7% | 6.2% | 13.7% | -2.3% | 32.6% |

| Middle East | 13.0% | 1.4% | 15.7% | -5.8% | 40.7% |

| North America | 28.1% | -1.2% | 2.7% | -1.5% | 37.7% |

These tables provide a comprehensive view of the year-on-year performance of air cargo across different regions, aiding in understanding the market dynamics and trends influencing the air cargo industry. (Source IATA, 2023)

Insights into Regional Performances:

Asia-Pacific: The region witnessed a remarkable 4.9% increase in air cargo volumes in August 2023 compared to the same month in 2022. This performance was significantly better than the previous month and was driven by growth on major trade lanes, including Europe-Asia and Middle East-Asia. Moreover, within-Asia trade lanes exhibited a notable improvement in August compared to July, further contributing to the region’s positive performance.

North America: Despite a slight decline of 1.2% in air cargo volumes, North American carriers showed an improved performance in August compared to July. Growth on major trade lanes like North America-Europe and Asia-North America saw a positive trend. Increased capacity also played a role in supporting this performance.

Europe: European carriers experienced a marginal decline of 0.2% in air cargo volumes in August compared to the same period in 2022. While this reflected a slight decrease, it was an improvement from the previous month. Notable growth in trade lanes such as Europe-Asia and Middle East-Europe contributed to this improvement.

Middle East: Middle Eastern carriers witnessed a 1.4% increase in cargo volumes in August 2023, indicating an upward trend from the previous month. The Middle East-Asia market showed consistent growth over the past three months, expanding year-on-year growth from 1.8% in June to 3.5% in August. Increased capacity further supported this positive trajectory.

Latin America: Latin American carriers demonstrated the strongest performance, with a remarkable 6.2% increase in cargo volumes compared to August 2022. This notable increase in performance was primarily attributed to strong growth on various trade lanes, contributing to the region’s positive momentum.

Africa: African airlines experienced a 4.7% decline in cargo volumes in August 2023 compared to the same month in 2022. This marked a significant decrease in performance compared to July. Notably, Africa-Asia trade routes showed a decline in August following a period of growth, impacting the overall performance of the region.

The positive growth in air cargo demand comes as a promising sign for the industry, providing a glimpse of recovery after a challenging period. As the sector heads into the traditional peak year-end season, optimism is brewing, albeit with caution, considering the uncertainties that persist in the global market. It remains crucial for stakeholders to closely monitor market trends and adjust strategies accordingly to ensure a sustainable and robust recovery for the air cargo industry.

Stay Tuned with Mettcover Blog & News for upcoming updates.