NOVO NORDISK makes fat gains whilst making Elon Musk lose weight. Its market-cap is now more than entire Denmark’s GDP.

- Samantha Garcia

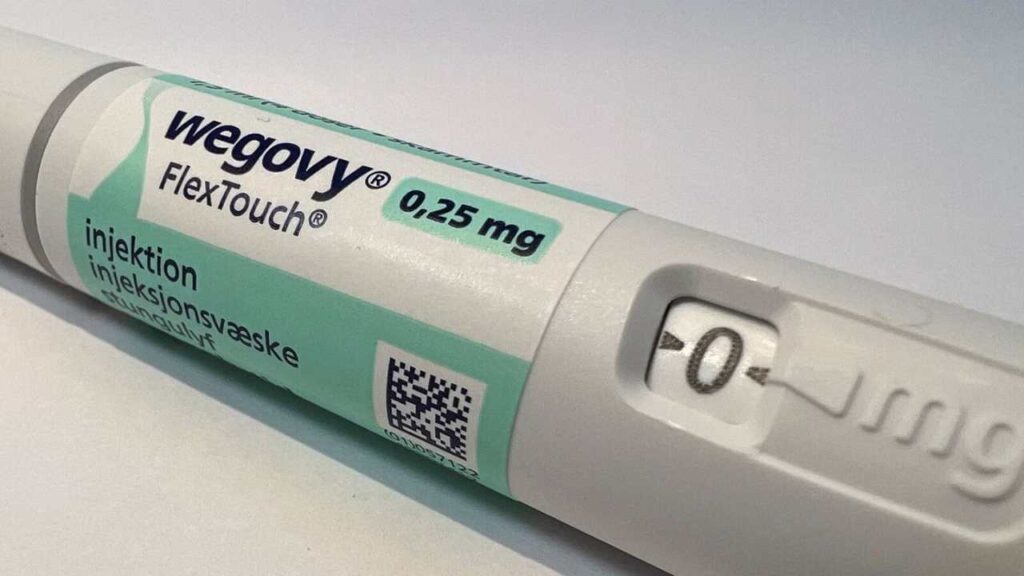

Danish pharmaceutical giant Novo Nordisk briefly seized the crown as Europe’s most valuable listed company, usurping the long reigning LVMH, the luxury conglomerate that counts Louis Vuitton amongst its flagship fashion brands. Interestingly enough, Novo Nordisk weight losing drug ‘Wegovy’ that was launched in 2021 has found takers across the world including Elon Musk and a host of other A-Listers.

(DATA CHART by LSEG via Reuters)

Novo Nordisk’s stellar growth in market cap and phenomenal success is the sole reason why Denmark’s economy didn’t contract in the second quarter of 2023, as predicted by most financial analysts.

The market frenzy around the now Europe’s 2nd most valued company and EU’s biggest pharmaceutical company is not misplaced. A recent August study concluded that the already bestselling weight losing drug, Wegovy’s cap, also has a substantial cardiovascular benefit. It reduced the risk of major cardiovascular events, including strokes, by a jaw-dropping 20% in overweight or obese individuals with a history of heart disease. This unexpected triumph could be the catalyst for insurers and health authorities to extend coverage for Wegovy, despite its hefty monthly price tag of $1,300 in the United States. It is notable that Wegovy makers charge a hefty premium in United States as compared to the drug’s price in the European Union countries.

The weight-loss drug market, currently valued at $6 billion, stands on the precipice of transformation. Projections paint a tantalizing picture – the market could swell to an astonishing $100 billion in annual sales within a decade. Novo Nordisk’s pioneering efforts in this domain have not only positioned it as a first-mover but also enabled the company to reap the benefits of an expanding market.

Wegovy’s competition, Eli Lilly, is also making significant strides with a weight loss drug called ‘Mounjaro’, set to receive U.S. approval later this year. This head-to-head competition promises to benefit patients by offering a range of innovative treatment options.

Novo Nordisk’s meteoric rise isn’t just a corporate tale; it’s a testament to the transformative power of innovation within the healthcare and biotech industry. As Novo marches ahead in the weight-loss and diabetes drug markets, its influence is poised to expand, potentially luring more investors and reshaping the pharmaceutical landscape.

Novo Nordisk’s brief yet audacious takeover of Europe’s corporate throne serves as a powerful reminder: Innovation and breakthroughs can create unforeseen ripples, altering the landscape of business in ways we can only imagine.